Congratulations! You have taken your first step into the exciting world of graded card investing. In this beginner’s guide, we will take you on a journey to explore the ins and outs of investing in graded cards. Whether you are a seasoned collector or a curious newcomer, this article aims to provide you with valuable insights, tips, and strategies to help you navigate this rapidly growing market with confidence. So, fasten your seatbelts, and let’s embark on this adventure together!

What are graded cards?

The concept of graded cards

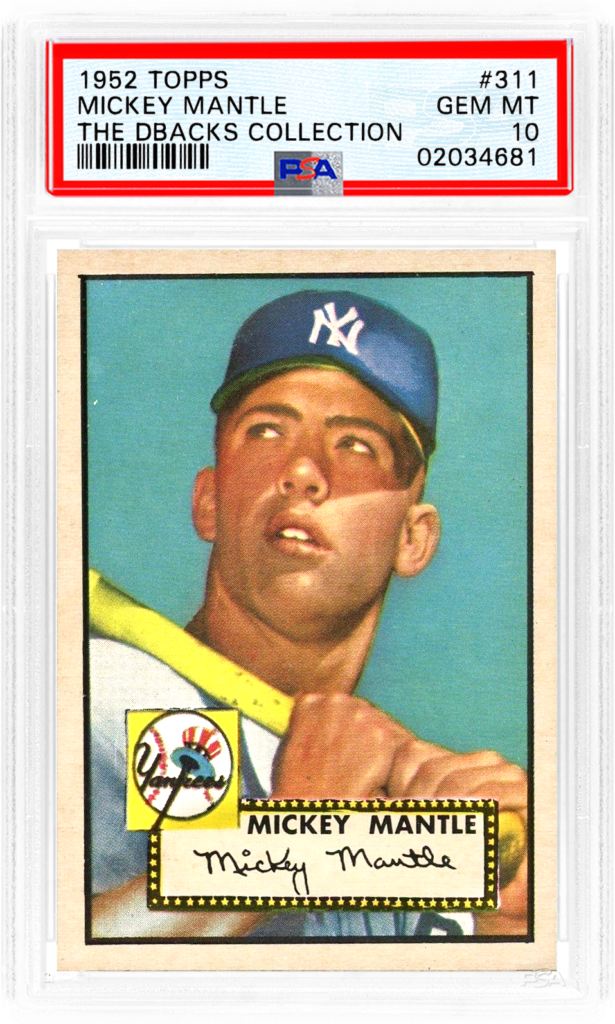

Graded cards are collectible trading cards that have been professionally assessed and assigned a grade by a third-party grading company. These grading companies evaluate the condition of the card, its authenticity, and sometimes even assign it a value. The cards are sealed in a protective case, commonly known as a slab, to preserve their condition and prevent tampering.

Why are they important in investing?

Graded cards are important in investing because they provide a standardized and reliable way to assess the condition of a collectible card. Investing in graded cards gives collectors and investors confidence in the authenticity and quality of the card they are purchasing. By assigning a grade, these cards become more valuable and desirable in the market, increasing their potential for future appreciation in value.

Different grading companies

There are several grading companies in the industry, each with its own criteria and grading scales. Some of the most renowned grading companies include Professional Sports Authenticator (PSA), Beckett Grading Services (BGS), and Sportscard Guaranty (SGC). These companies have established themselves as leaders in the field and are trusted by collectors and investors worldwide. When considering investing in graded cards, it’s essential to be aware of the reputation and credibility of the grading company.

Factors to consider before investing

Card rarity and scarcity

One of the key factors to consider before investing in graded cards is the rarity and scarcity of the card. Cards that are limited in production or have a low population count in high grades tend to be more valuable. Researching the card’s production numbers and understanding its overall scarcity within the market can help determine its investment potential.

Condition of the card

The condition of the card plays a crucial role in its value and investment potential. Graded cards are assigned a numerical grade that reflects their overall condition, with higher grades indicating better condition. Investing in cards with higher grades ensures that you are acquiring cards in the best possible state, which tends to hold its value and appreciate over time.

Historical relevance

Cards featuring historically significant moments or players tend to be more sought after by collectors and investors. Historical relevance adds a layer of sentiment and nostalgia to the card, making it more desirable in the market. Researching the significance of the card, such as record-breaking performances or championship victories, can help gauge its investment potential.

Popularity of the player

The popularity of the player featured on the card can greatly impact its investment potential. Players with a large and dedicated fan base often drive up the demand for their cards, increasing their value. Proven performance, awards, and individual achievements contribute to the popularity and desirability of a player’s card. Consider investing in cards featuring players with a strong fan following and a promising career trajectory.

Understanding card grading

Graded card attributes

Graded cards are assessed based on several attributes, which include the card’s centering, corners, edges, surface, and overall eye appeal. These attributes determine the card’s condition and are evaluated by the grading companies during the grading process. Understanding these attributes and their importance in determining a card’s grade can help investors make informed decisions when purchasing graded cards.

Grading scales

Different grading companies utilize various grading scales to assess the condition of cards. For example, PSA uses a scale from 1 to 10, with 10 being the highest grade, while BGS uses a scale from 1 to 10, with subgrades for each attribute. Familiarizing yourself with the grading scales of different companies can help you understand the nuances and differences between them, enabling you to make better investment choices.

Factors affecting grading

Many factors can affect the grading of a card, including centering, corners, edges, surface flaws, and print imperfections. These factors are carefully assessed by grading companies to ensure an accurate representation of the card’s condition. It’s important to understand these factors and their impact on the grading process to determine the overall value and investment potential of a graded card.

Researching and evaluating graded cards

Market trends and demand

Researching current market trends and understanding the demand for specific cards is crucial when evaluating graded cards for investment. Monitoring market trends can provide valuable insights into which cards are increasing in value and which are losing traction. Studying market trends allows you to make informed decisions and identify investment opportunities that align with your goals and risk tolerance.

Comparing recent sales

Analyzing recent sales of similar graded cards can give you an idea of their current market value and potential investment return. Comparing prices across different platforms and auctions can help identify any discrepancies or undervalued cards in the market. This information provides a benchmark for evaluating the investment potential of graded cards and determining whether they are reasonably priced.

Card authentication

Card authentication is a crucial step in verifying the legitimacy of a graded card. Investing in cards that have been authenticated by reputable grading companies ensures that you are purchasing genuine items. Card authentication prevents the risk of unknowingly acquiring counterfeit cards, which can be detrimental to your investment. Always verify the card’s authenticity before making any purchases.

Pop reports and population

Pop reports, short for population reports, provide information on the number of cards graded by a particular grading company. These reports indicate how many cards of a specific grade exist in the market. Checking pop reports can help determine the rarity and scarcity of a card, influencing its investment potential. Low population counts in high grades often indicate a more valuable and sought-after card.

Building a collection and diversification

Acquiring rookie cards

Investing in rookie cards can be a smart strategy as they often have a higher potential for appreciation in value. Rookie cards are the first officially licensed cards of a player, and they tend to hold sentimental value among collectors and investors. Researching the performance and potential of rookie players can help you identify promising investments in the rookies’ card market.

Vintage vs. modern cards

Deciding between vintage and modern cards is an important consideration when building a collection. Vintage cards are those from earlier eras, typically considered more rare and valuable due to their age and scarcity. On the other hand, modern cards feature current players and often have more availability in the market. Choosing to invest in either vintage or modern cards, or a mix of both, depends on your investment strategy and personal preferences.

Investing in different sports

Diversifying your collection by investing in different sports can help mitigate risk and maximize potential returns. Each sport has its own fan base and market dynamics, and investing across multiple sports allows you to tap into different market opportunities. Researching the popularity and trends in various sports can guide your decision to invest in specific sports cards and expand your investment portfolio.

Investing in sets

Investing in complete sets of graded cards can be a strategic way to build a collection. A set comprises all the cards from a specific release or series, and having a complete set adds value and appeal to the collection. Collectors often seek complete sets, creating a demand that can lead to increased value over time. Investing in sets can offer a well-rounded and comprehensive collection, attracting a wide range of potential buyers.

Buying and selling graded cards

Buying from reputable sources

When purchasing graded cards, it is crucial to buy from reputable sources to ensure authenticity and reliability. Reputable sources include established collectibles stores, reputable online marketplaces, and auction houses. These sources have a track record of dealing with authentic and accurately graded cards, minimizing the risk of purchasing counterfeit or misrepresented items.

Selling strategies

Before selling graded cards, it’s important to have a clear strategy in mind. Determine your goals, such as maximizing profits or liquidating some assets. Consider whether you want to sell individual cards or entire collections. Research current market conditions and trends to identify the optimal time to sell. Having a well-thought-out selling strategy helps you navigate the market and make informed decisions to achieve your desired outcomes.

Auction houses vs. online platforms

Deciding between auction houses and online platforms when buying or selling graded cards is a matter of personal preference and strategy. Auction houses provide a platform for competitive bidding and potential higher returns, but they often involve fees and commissions. Online platforms offer convenience, wider reach, and ease of transactions, but they may involve more research and due diligence to ensure credibility. Consider your goals, timeline, and comfort level when choosing between auction houses and online platforms.

Storage and maintenance of graded cards

Protecting cards from damage

Proper protection is crucial to maintain the condition and value of graded cards. Avoid handling cards excessively, as oils and dirt from hands can damage the surface. Use clean gloves or a soft cloth when handling the cards. Keep the cards away from direct sunlight, extreme temperatures, and high humidity to prevent fading, warping, or mold growth. Handling and storing graded cards with care preserves their quality and investment potential.

Storage options

There are various storage options available for graded cards, each with its own benefits and considerations. Card savers, semi-rigid holders, and top loaders are popular options for individual card storage. These options provide protection and are stackable for easy organization. For larger collections, card storage boxes with dividers can be used to store multiple cards efficiently. Consider using acid-free materials to ensure the longevity and preservation of your graded cards.

Maintenance tips

Regularly inspect your graded cards for any signs of damage or deterioration. Clean the holders or slabs with appropriate cleaning solutions or wipes to remove any dirt or residue that may have accumulated over time. Avoid using harsh cleaning agents or abrasive materials that can scratch or damage the case. By conducting regular maintenance and being proactive in protecting your cards, you can maintain their condition and maximize their investment potential.

The potential risks and challenges

Market volatility

As with any investment, graded card investing carries inherent risks due to market volatility. The values of graded cards can fluctuate depending on various factors, such as player performance, market demand, and economic conditions. It’s important to stay updated on market trends and exercise caution when navigating volatile periods to ensure the best possible investment outcomes.

Counterfeit cards

Counterfeit cards are a significant risk in the graded card market, especially with the increasing popularity and value of certain cards. It is essential to purchase graded cards from reputable sources and verify their authenticity through proper authentication channels. Educating yourself on the characteristics and identifying marks of legitimate cards can help in detecting counterfeit cards and safeguarding your investments.

Changing player values

A player’s performance and reputation can significantly impact the value of their graded cards. Positive or negative developments in a player’s career, including injuries, transfers, or retirements, can cause fluctuations in the market value of their cards. Staying informed about players’ performances, potential future prospects, and overall market sentiment can help you navigate these changes and make informed investment decisions.

Liquidity limitations

The graded card market may present limitations in liquidity, meaning it may take time to find a buyer or sell a particular card. Some cards may have less demand or a narrower buyer pool, resulting in slower turnover. Investing in cards with higher demand and broader market appeal can help mitigate liquidity limitations. Patience and a long-term investment strategy can also offset any potential challenges related to liquidity.

Long-term vs. short-term investments

Investing strategies

Determining your investment horizon and goals is crucial when deciding between long-term and short-term investment strategies. Long-term investments involve holding onto graded cards for an extended period, banking on their potential appreciation over time. Short-term investments, also known as flipping cards, involve buying and selling cards quickly to take advantage of short-term price fluctuations. It’s important to align your investment strategy with your financial goals and risk tolerance.

Value appreciation over time

Graded cards have the potential to appreciate in value over time, especially for cards featuring popular players or significant moments in sports history. Historical data and market trends suggest that well-graded cards, particularly those associated with legendary players, have shown considerable appreciation in value. However, it’s essential to note that past performance is not indicative of future results, and market conditions can change over time.

Flipping cards for quick profits

Flipping cards can be a lucrative short-term investment strategy if executed with precision and market knowledge. By identifying and capitalizing on short-term price fluctuations, investors can buy cards at a lower price and sell them quickly for a profit. This strategy requires constant monitoring of the market, staying updated on player news, and having a keen eye for undervalued cards. Flipping cards can provide immediate gains, but it also carries higher risks and requires careful timing and decision-making.

Future outlook of graded card investing

Emerging trends

Graded card investing is experiencing a surge in popularity, with more collectors and investors entering the market. The demand for high-quality graded cards is expected to continue growing, driving up their value. Emerging trends, such as crossover collecting and the rise of international markets, present new opportunities for investors. With the ever-changing landscape of the graded card market, it’s important to stay informed and adapt to these emerging trends to maximize investment potential.

Integration of technology

Advancements in technology are revolutionizing the graded card industry. Digitized grading certificates, blockchain technology, and online marketplaces are streamlining transactions and enhancing card authenticity. The integration of technology allows for increased transparency, verifiability, and ease of access for both buyers and sellers. As technology continues to evolve, it is expected to have a significant impact on the future of graded card investing.

Influence of international markets

The influence of international markets on the graded card industry is becoming more prominent. Collectors and investors from around the world are showing interest in graded cards, leading to increased demand and price appreciation. As international markets grow, the accessibility and availability of graded cards from different countries and sports are expanding. Investing in cards that have global appeal can diversify your collection and open up new investment opportunities.

Graded Card Investing offers a unique and exciting way to combine your passion for collecting with the potential for financial gains. By understanding the concept of graded cards, evaluating various factors, and conducting thorough research, you can navigate the market with confidence and make informed investment decisions. Whether you choose to invest in rookie cards, vintage or modern cards, or explore different sports, graded card investing has the potential to be a rewarding and enjoyable venture. As with any investment, it’s crucial to stay informed, adapt to market trends, and continuously evaluate your portfolio to maximize long-term returns. With the future outlook of graded card investing looking promising, now is a great time to start your journey into this fascinating world.

Hi there! I’m Felix Gonzalez and I am the owner of Card Collecting Insider, and I’m thrilled to welcome you to my site! With our tagline “Uncover the Art of Collecting, One Card at a Time,” I’m here to provide you with expert insights, valuable resources, and the latest trends in the world of card collecting. Whether you’re a seasoned collector or just starting out, I’m dedicated to helping you discover hidden gems and sharing insider tips to elevate your collection. So join me on this exciting journey, as I dive deep into the captivating realm of card collecting. Let’s unlock the true beauty of these collectible treasures together!